The Ultimate Guide to Medical Billing in Colorado (2025 Update)

Medical billing in Colorado is evolving fast, with constant payer updates, compliance requirements, and new telehealth billing codes. Whether you’re running a family practice in Denver, an urgent care in Colorado Springs, or a behavioral health center in Boulder understanding Colorado medical billing rules can make or break your revenue.

In this comprehensive guide, we’ll explore everything from payer specific billing tips to state regulations and outsourcing benefits for local providers.

Why Medical Billing in Colorado Is Different

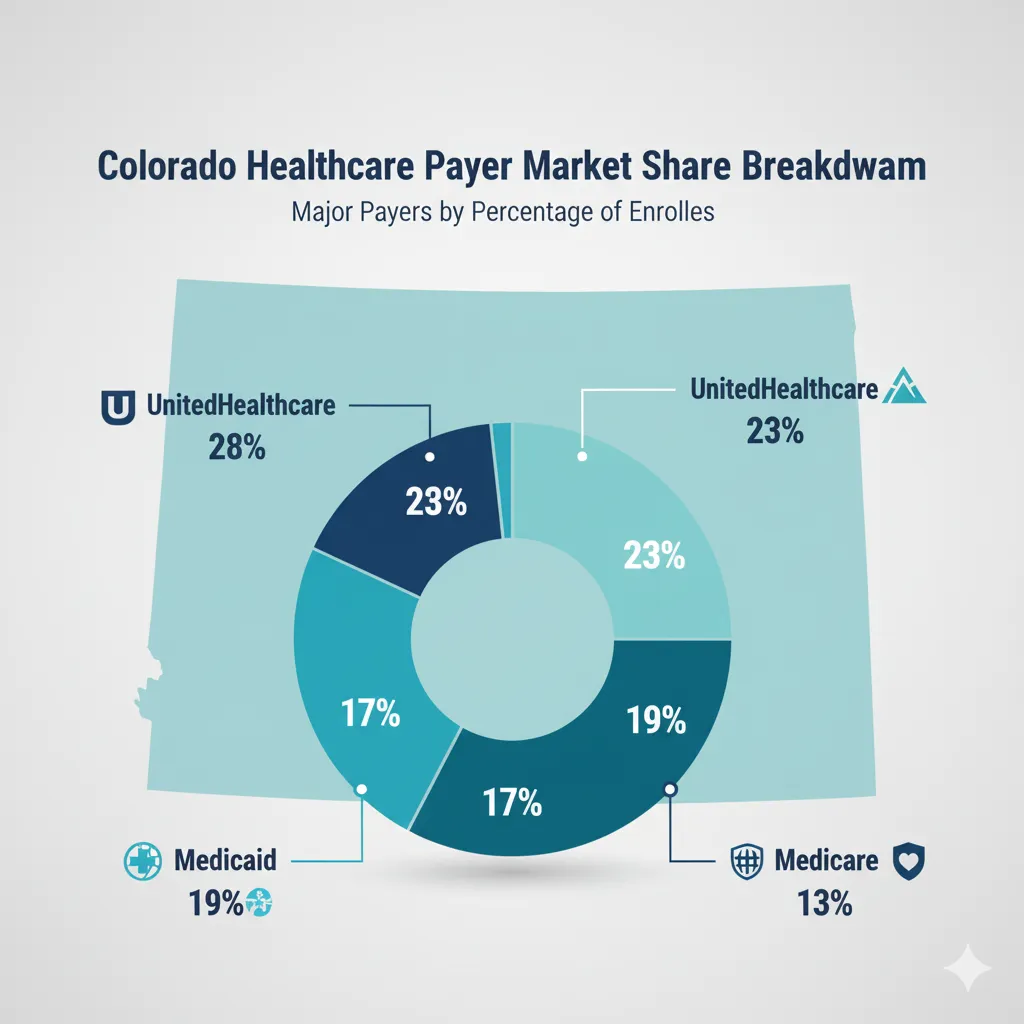

Colorado’s healthcare market stands out due to.

A high mix of commercial and Medicaid patients

Active participation from payers like UnitedHealthcare, Anthem, and Colorado Access

Strong focus on telehealth and mental health parity laws

This diversity makes medical billing services in Colorado more complex but also more profitable for practices that do it right.

Understanding Colorado Medical Billing Rules & Regulations

Billing in Colorado must align with both federal HIPAA standards and state specific mandates.

Colorado Medicaid Billing Guidelines

Colorado Medicaid requires.

Electronic claim submission through the Colorado interChange system

Use of ICD 10 and CPT codes approved by CMS

Documentation compliance for audits and prior authorization

Major Payers in Colorado Who You’ll Bill Most Often

1. UnitedHealthcare

Common issues include modifier mismatches and duplicate claim denials.

Pro Tip: Always verify eligibility 24 hours before claim submission.

2. Anthem Blue Cross Blue Shield

Known for strict pre-authorization requirements and behavioral health audits.

Pro Tip: Keep a payer-specific documentation checklist.

3. Cigna & Aetna

These payers follow national CMS policies but may delay payments for incomplete documentation.

4. Colorado Medicaid

Most common among FQHCs, rural clinics, and family practices.

Requires timely claim submission within 120 days of service.

Challenges Faced by Medical Practices in Colorado Billing

Denials from Payers

Most denials arise from missing authorizations, invalid CPT codes, and incomplete notes.

Delayed Payments

Typical A/R days range between 45 to 60 days for clinics handling billing in-house.

Staff Turnover

Frequent billing staff changes can disrupt claim cycles.

Why Outsourcing Medical Billing in Colorado Makes Sense

Outsourcing to local experts like CureBill Medical Billing helps practices.

Cut claim denial rates from 18% to under 5%

Improve payment accuracy to 98%+

Reduce admin time by 30+ hours/month

Maintain full HIPAA and HITECH compliance

Choosing the Right Medical Billing Partner in Colorado

What to Look For

HIPAA & HITECH Certification

Experience with Colorado payers

Proven denial management strategies

Real-time reporting dashboards

Why CureBill Is Trusted by Colorado Providers

CureBill specializes in:

Custom billing workflows for specialties (primary care, urgent care, behavioral health)

Real time analytics for claim tracking

Dedicated A/R recovery teams for faster reimbursements

Final Thoughts Stay Ahead in 2025

The future of medical billing in Colorado will rely on automation, payer integration, and expert outsourcing. With new CMS updates and stricter audit rules, having a trusted partner like CureBill ensures your billing stays profitable, accurate, and compliant.

Medical billing in Colorado follows a detailed process that involves submitting accurate claims to insurance providers such as UnitedHealthcare, Anthem, Cigna, and Colorado Medicaid. Each claim must comply with state-specific billing regulations, payer guidelines, and HIPAA standards to ensure faster reimbursement and fewer denials.

The average cost of medical billing in Colorado typically ranges between 4% to 8% of monthly collections. The exact percentage depends on your specialty, claim volume, and whether your practice uses in-house billing software or outsourced billing companies like CureBill that manage end-to-end revenue cycle operations.

Colorado’s healthcare network is primarily covered by UnitedHealthcare, Anthem Blue Cross Blue Shield, Cigna, Aetna, and Colorado Medicaid. Understanding each payer’s claim submission process and denial rules is crucial for maintaining consistent cash flow and avoiding unnecessary payment delays.

To minimize denials, practices should ensure accurate CPT coding, patient eligibility verification, and pre-authorization checks. Partnering with a Colorado-based billing company that provides denial management and AR recovery services—like CureBill—helps reduce rejections and increases overall revenue recovery.

Yes. Reputable medical billing companies in Colorado, including CureBill, strictly follow HIPAA and HITECH compliance standards. They ensure data encryption, secure claim transmission, and confidentiality of all patient records during the billing and claims process.

For small or mid-sized practices in Denver, outsourcing billing to a local Colorado billing company offers the best value. Services like CureBill provide customized medical billing solutions, claim follow-ups, and EHR integration to help clinics improve accuracy and reduce administrative workload.

Absolutely. CureBill’s specialized Medicaid billing team assists clinics and hospitals in Colorado with claim submission, resubmission, audit support, and compliance checks. This ensures faster reimbursement and reduced administrative burden for healthcare providers.